Fast corporate bodies loan

Fast Corporate Loan

Fast corporate bodies loan

Active property loans

Need artisan credit loan?

Group daily savings

Cool comfort savings

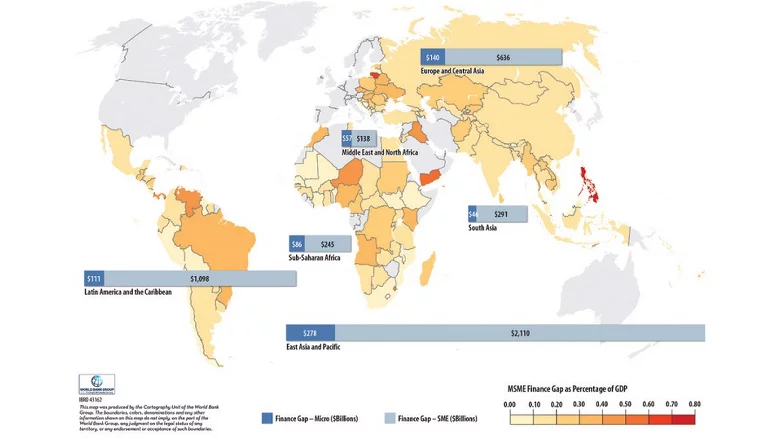

SMEs are less likely to be able to obtain bank loans than large firms; instead, they rely on internal funds, or cash from friends and family, to launch and initially run their enterprises. The International Finance Corporation (IFC) estimates that 65 million firms, or 40% of formal micro, small and medium enterprises (MSMEs) in developing countries, have an unmet financing need of $5.2 trillion every year, which is equivalent to 1.4 times the current level of the global MSME lending. East Asia And Pacific accounts for the largest share (46%) of the total global finance gap and is followed by Latin America and the Caribbean (23%) and Europe and Central Asia (15%). The gap volume varies considerably region to region. Latin America and the Caribbean and the Middle East and North Africa regions, in particular, have the highest proportion of the finance gap compared to potential demand, measured at 87% and 88%, respectively. About half of formal SMEs don’t have access to formal credit. The financing gap is even larger when micro and informal enterprises are taken into account.

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!